Data

May 01, 2024

FCA’s Consumer Duty: What lies ahead in 2024 for financial services firms?

The Financial Conduct Authority (FCA) has issued an open ‘Dear CEO’ letter that sets out an expectation of conduct for financial services firms to better serve consumers and the economy via the Consumer Duty Act that came into force on 31st July last year. The Treasury, debt charities, and consumer groups in the space have been keen to see regulation address the challenges of access to affordable credit and have clear protection in place to guard against over burden.

The aim of the ‘Dear CEO’ letter series is to support firms as they progress with their implementation plans. The Consumer Duty sets out guidelines that centre on delivering a higher level of consumer protection in retail financial markets, where payment plans and easy credit compete.

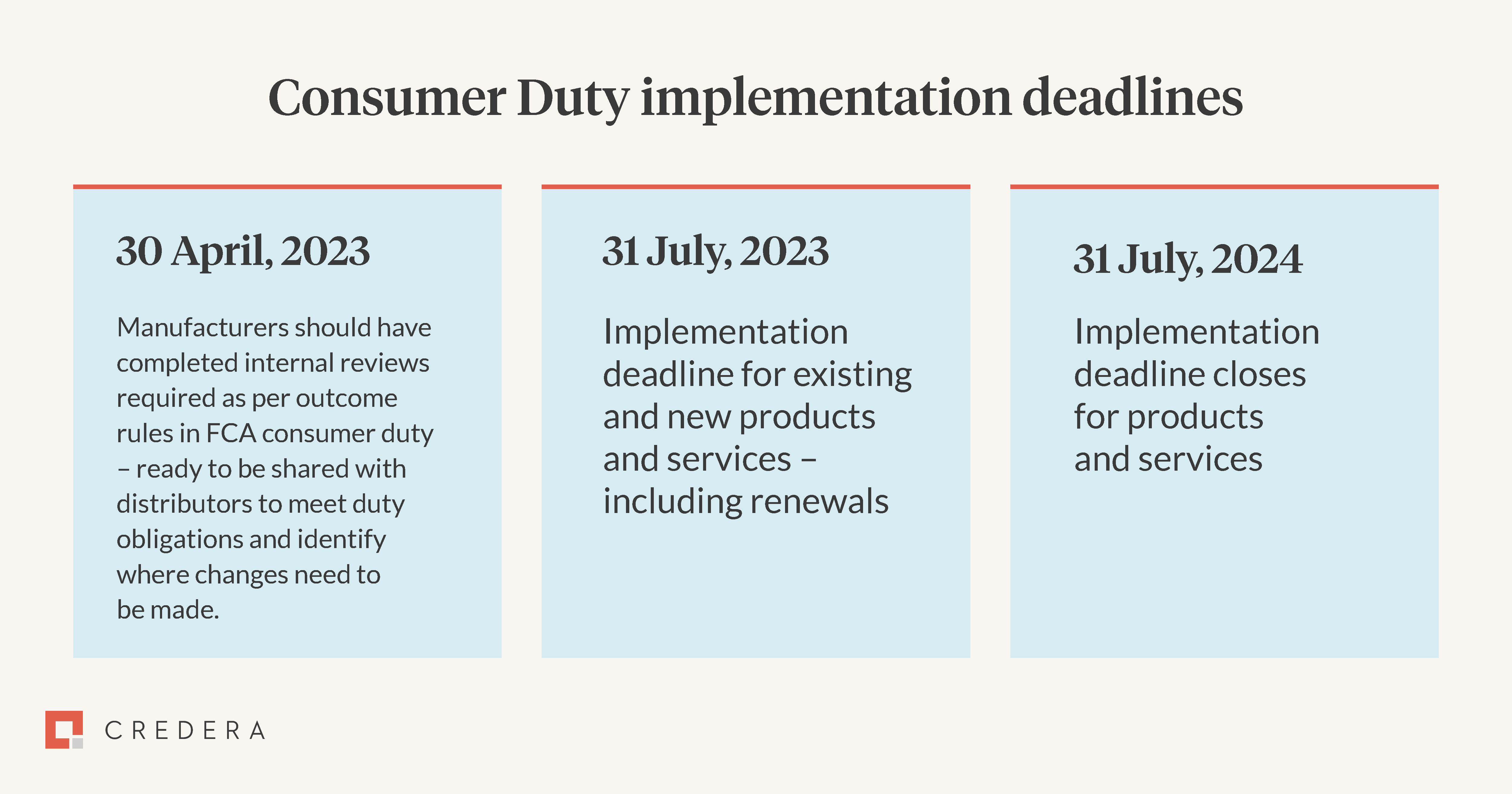

As the 31 July 2024 deadline approaches, FCA is setting out an agenda and the areas where it is expecting financial firms to focus on. In its January feedback for firms on their implementation plans, it highlighted effective prioritisation, embedding the substantive requirements, and working with other firms as acceleration levers that will help them implement the Duty in time.

In this blog post, we uncover how the Consumer Duty guidelines affect business models for financial services firms and how they can leverage the new guidelines to build a stronger, more valuable relationship with their customers.

Buy now, pay later firms

The buy now, pay later (BNPL) firms that have been under FCA’s review since July 2023 (including firms like ClearPay and Klarna, who rapidly grew during the pandemic) broadened the purview, making regulation fit for purpose and aligned with changing consumer behaviour.

‘Acting in good faith’ and ‘avoiding foreseeable harm’ are key outcome-based principles in the regulation but are open to interpretation in credit operations. The Duty rules require firms to consider the needs, characteristics, and objectives of their customers—including those with characteristics of higher vulnerability—and how they behave at every stage of the customer journey. BNPL firms would benefit from a deeper understanding of customer affordability in the sale process to avoid overburdening consumers with additional debt.

A new focus on data collection, treatment, and published materials is key to ensure compliance:

Product disclosure documents are provided to customers during the decision-making process containing clear and detailed information about the features, risks, and costs associated with a product or service.

Customer complaints records management, where BNPL firms maintain a record of customer complaints and how they were resolved to identify any issues customers have with an organisation’s products or services. Firms must also take the necessary action to address complaints.

Sales and marketing materials review to ensure communication in the material is clear, accurate, timely, and not misleading. This includes any information provided to customers about products and services and covers a broad range of materials across product brochures, websites, apps, and advertisements.

Staff training collaterals review, including any training on the Consumer Duty Act and other relevant regulations, which helps demonstrate staff are equipped to provide appropriate guidance to customers, instilling confidence in operations.

Customer interaction records of any interaction, advice, or guidance provided helps demonstrate compliance with the Consumer Duty Act.

Banks and building societies

For the purposes of the Duty, all firms are treated as ‘manufacturers’ if they have a role in the design or operation of a product or service. The definition of a manufacturer and a co-manufacturer are key elements in understanding where responsibilities lie for a fair value assessment of products and services and how this is communicated to the customer.

For banks and building societies, this includes building more transparency around mortgage interest rates, fees, and potential risks. They must be able to demonstrate fair and responsible lending processes that prevent discrimination and fair assessment of financial merit.

Under the regulation, firms will need to not only understand and evidence fair outcome, but also whether those outcomes are being met, how they affect those outcomes, and how to intervene to prevent unfair operational practices. For firms that acquire books of regulated loans, they have a responsibility to gather relevant information from the seller and demonstrate compliance with the Consumer Duty to address the FCA’s focus on ensuring no poor customer outcomes arise due to the sale of a portfolio.

The frameworks that involve assessing fair value of financial products and services are complex, involving assessing costs and benefits of the product or service, business models, assessment of the target market, supply chains, and the end-to-end customer journey that has the potential to impact the price to customers. ‘Fair value,’ therefore, is a collective responsibility and requires a compliant review of value assessment from an end-to-end perspective.

As FCA considers profit margins relevant to the assessment of fair value, it could be flying dangerously close to being a pricing regulator. Impact on business models for building societies—whose entire business model is taking savings and lending capital—could come under future scrutiny for possible price discrimination (i.e., charging different prices to different target consumer groups for the same products and services).

The ease and accuracy of evidencing fair business activities will determine speed to market for new products and services and will have a direct influence on market access and success. Firms will need to adopt a data‑led approach to bring in transparency and accountability across business processes to more quickly identify practices that unfairly impact consumers.

Wealth management firms

Wealth managers’ compliance with the Duty may require significant adjustments to business models, client engagement strategies, and even product offerings. Firms will need to revisit and potentially reshape their approach to align with the Duty. The Duty requires additional disclosure requirements from wealth management firms. This includes the need for clearer and more comprehensive communication around fees, risks, and potential conflicts of interest. There is also a heightened emphasis on assessing and communicating investment risks to clients. Conducting thorough client assessments, understanding their financial goals, and providing suitable advice—all whilst maintaining clear traceability of evidence is now more important than ever.

The compliance processes’ transparency is another key area to focus on—and this means having operational frameworks and governance processes in place that can trace and evidence all activities involved in providing fair advice. This could translate into investment in systems, processes, and training to ensure compliance, as well as regular audits and internal reviews.Firms are also increasingly looking to artificial intelligence (AI) for compliance monitoring and data analytics for client profiling.

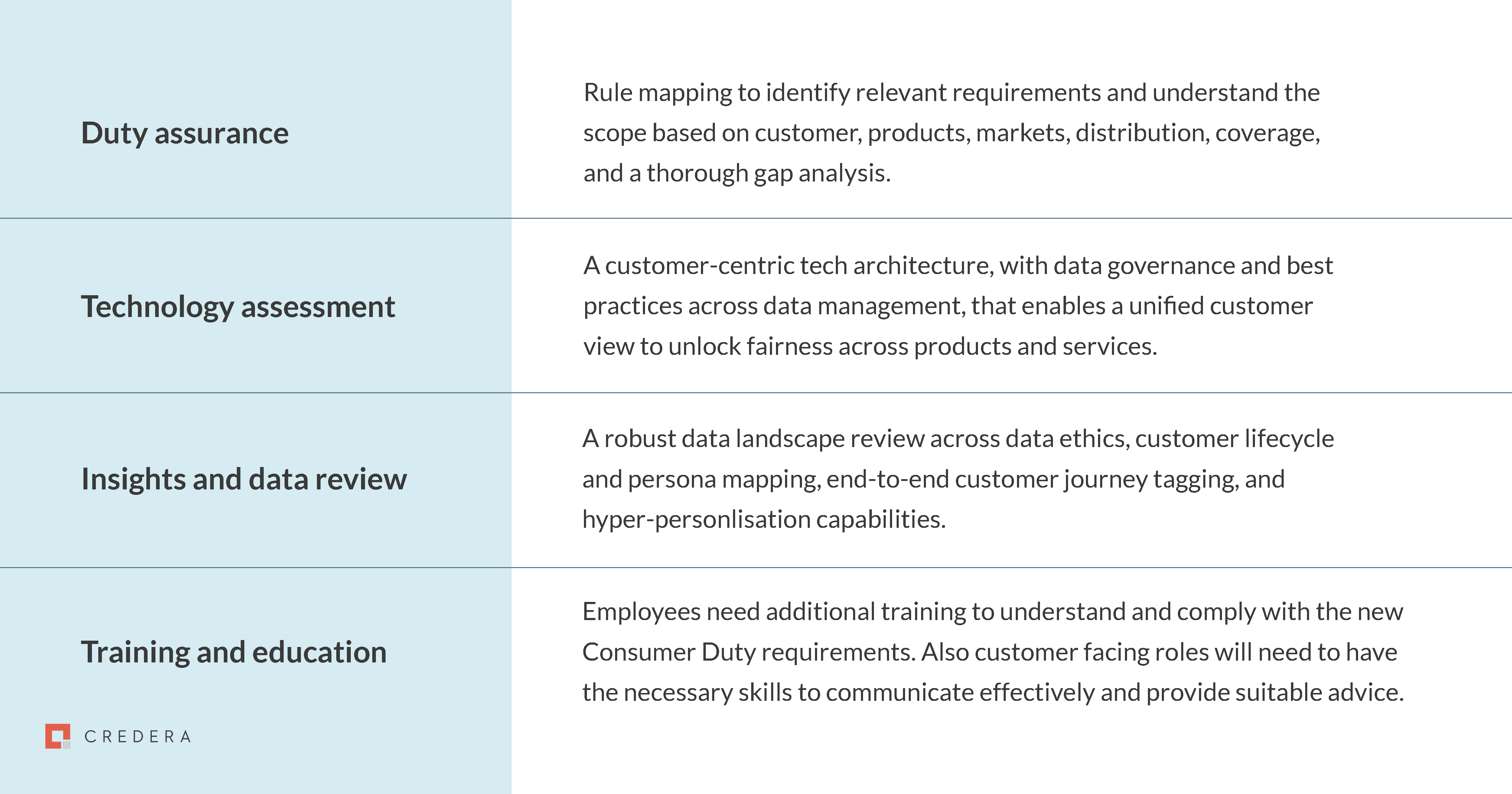

All financial services firms need a governance framework for Duty implementation that covers the below tenets:

Six effective ways for financial services firms to navigate FCA regulations in the UK

Most firms should look to streamline their frameworks to include data and technology partners or third parties they are integrated with to build a scalable and flexible system that allows for monitoring and measuring outcomes as required. Some initial key steps firms should take include:

Provide information access: Firms are expected to create transparency by giving customers the information they need at the right time and presented in the right way.

Enhance customer communications: Firms need to enhance customer communications and standardise, regulate, and harmonise communication templates to ensure communications are timely and cannot be considered ‘predatory’ in their nature.

Re-design customer journey: By re-designing a product or service customer journey and the way they engage with customers at each touch point, organisations can drive customer-centricity across the business.

Leverage omnichannel experiences: To promote financial wellbeing and provide real-time access to products and services, firms should ensure seamless omnichannel experiences through real cross-channel orchestration and flow.

Leverage data and insights: Firms need to leverage enterprise-wide data to help identify vulnerable customers, tailoring messages, and services accordingly. The Duty includes annual processes, such as the product value assessments that rely not only on external data, but internal historical data as well.

Leverage AI: AI could be leveraged to assess the effectiveness of the communication (e.g., analysis of sentiment in automatically transcribed customer call with an advisor or agent), employ data-driven pivots, and deliver better personalisation.

To meet the 2024 Duty goal for existing and closed products and services, firms need to review their product governance, risk control framework, and customer experience methodologies. It is important to conduct a thorough review of relevant policies and procedures, key progress indicators (KPIs), Senior Managers and Certification Regime (SM&CR), and training outcomes. This includes oversight across governance and culture, with access to complaints-handling analytics.Customer and staff enablement portals and education materials are powerful tools that can also be deployed for access at any time and help create a culture of fair conduct.

Building trust

By promoting a culture of constructive customer education, transparency, and engagement, organisations will go a long way in building trust and fostering long-term relationships to meet the Duty requirements. It is important for firms to adopt a products and services architecture that eliminates the complicated processes, confusing language, disincentives, and hidden fees in delivery, so customers can make better-informed decisions.

Having a compliant products and services communication plan, a price and value assessment, as well as greater transparency in customer information and support are all key governance pillars firms will need to adopt in their strategy and planning processes for optimal success.

How Credera can help

At Credera, we help financial services and insurance companies scope, assess, shape, and deliver significant change to positively impact customer experiences and journeys to meet complex regulations.

We also help firms across assurance, document and data review, controls review, outcome testing and evaluation, and Duty deployment to best respond to Duty compliance regulations and leverage the change in processes and tooling to build a stronger, more valuable customer base.

Contact Us

Let's talk!

We're ready to help turn your biggest challenges into your biggest advantages.

Searching for a new career?

View job openings